1950年代以来、トレーダーに知られているストキャスティックオシレーターは、株式市場や外国為替取引の両方で使用されるお気に入りのツールの1つであり、その汎用性と正確性から、すべてのトレーダーが知っているべき重要なテクニカル指標の1つと考えられています。では、外国為替取引におけるストキャスティクとは何か、どのように機能し、どのようにしてより多くの利益を得るのに役立つのでしょうか?

ストキャスティックオシレーターの理解

理論から始めましょう。具体的には、外国為替取引におけるストキャスティックオシレーターとは何かという問いです。このツールの特徴を理解することは、外国為替取引におけるストキャスティクの使用方法を知ることも含まれます。

つまり、ストキャスティックオシレーターはトレンドの終わりを明確に示すインジケーターです。トレンドが上向きの場合、価格が前の水準にとどまるか上昇し続けることをトレーダーに知らせます。下降トレンドの場合、前の終値は価格よりも高くなります。言い換えれば、ストキャスティックは価格の勢いを測定し、反応します。これは最初に方向を変えるインジケーターであり、価格がそれに続きます。チャート上では、MACDと似ており、トレーダーが資産に関する決定をするために使用する2本のラインがあります。

要約:外国為替のストキャスティックインジケーターは、終値と高値と安値の範囲との比較として説明され、実際に起こる前に潜在的な価格変動を予測します。

ストキャスティック外国為替戦略の基礎

理論から実践に移りましょう。外国為替取引におけるストキャスティックインジケーターの使用方法は?この取引ツールを使用すると、特定の資産の買われすぎや売られすぎの状態を評価し、潜在的な価格反転を示すこともできます。これにより、トレーダーは資産を買うまたは売るための最適な時期と価格を特定する絶好の機会が開かれ、潜在的に利益をもたらす取引が可能となります。

すべてが非常に簡単に機能します:

- ラインは0から100の範囲内で移動します。

- ラインが80を超えると、インジケーターは市場で資産が過買いされていることを示します。

- ラインが20から0の範囲に落ちると、資産が過売りされていることを示します。

トレーダーはこれらのシグナルをさらに解釈する必要がないことがよくあります。これらは明確で他のインジケーターによって簡単に確認できます。残されたことは、市況に応じて適切に対応し、短期または長期の予測に基づいて取引戦略を適用することです。

ストキャスティックオシレーターのForex読み取りに基づいて、過買いシグナルで売却を決定したり、インパルスで購入を行ったり、長期リスクに対してヘッジを行ったり、この情報を完全に無視したりすることができます。次の行動は、完全に取引スタイル、アプローチ、投資目標、およびその他の要因に依存します。特定の状況でどのように行動すべきかについて疑問がある場合は、技術的または基本的分析のための追加ツールが明確さをもたらし、よく考えられた判断を下すための情報を提供できます。

本質的には、ストキャスティック戦略Forexラインが過売り範囲に入ると、トレーダーは買い、逆に、ラインが過買い範囲にあるときは売りポジションを開きます。ただし、そのようにインジケーターの読み取りに自動的に反応すべきではありません。インジケーターラインは特定の範囲内に長期間留まる可能性があるため、最も効果的な戦略は、追加のサポートおよびレジスタンスライン、および移動平均線(MA)を使用することです。

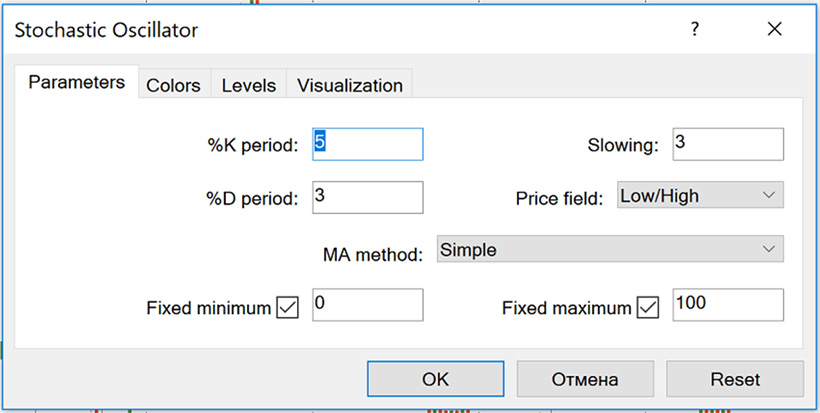

ストキャスティックインジケーターの設定

外国為替取引のステューキャスティック指標は、MetaTrader 4および5プラットフォームの主要ツールの1つであり、これらのプラットフォームでの構成は非常に簡単です。単にチャートに追加するだけです(「インジケータ」メニューの中にあります - 「ステューキャスティックオシレーター」)。

デフォルトでは、設定は5、3、3です。これらのデフォルト設定に加えて、トレーダーはいくつかのバリエーションも使用します:

- ファストステューキャスティック(5、4):価格変動に非常に迅速に反応します。

- スローステューキャスティック(14、3):これらの設定は誤ったシグナルを除外するのに役立ちます。

- フルステューキャスティック(14、3、3):市場変動に最適に反応しますが、めったに誤ったシグナルを出しません。

よく、14、3、3などのパラメータと並んで、21、5、5も使用されます。

ステューキャスティック外国為替戦略:買いシグナル

ステューキャスティックシグナル外国為替指標は、資産の買い時や売り時を100%確実に提供するわけではありません。明確な買いシグナルを得るためには、より広い時間枠でのトレンドを考慮する価値があります。

また、ステューキャスティックダイバージェンス外国為替にも注意を払ってください:価格チャートとのダイバージェンスがある場合。売りシグナルは、価格が低い低値に達するときに発生し、同時にオシレータが高い低値に達するときです。この状況は、ベアリッシュな勢いが弱いことを示し、潜在的に利益をもたらす取引を示しています。

ステューキャスティック外国為替戦略:売りシグナル

外国為替でステューキャスティックオシレーターを使用する方法について話す際に、売りのシグナルは指標が80以上に達するとき(買われすぎゾーン)に提供されることをすでに述べました。ただし、以下の秘訣を使用することで、ステューキャスティック外国為替取引戦略を最適化できます:

- %Kラインが%Dラインを下回るときにベアリッシュクロスオーバーを探します。このようなクロスオーバーは、既存のトレンドが勢いを失っていることを示し、売り注文で市場に参入する良いタイミングです。

- Price Actionで観察を確認し、抵抗レベルでベアリッシュなローソク足パターンや他の逸脱を見つけた場合、これは売りシグナルとして解釈できます。

- 主要なトレンドに逆行する取引を開かないように注意してください。それは不利な決定となる可能性があります。

これらのニュアンスを理解することで、ストキャスティクス外国為替取引システムをマスターし、効果的な取引や投資の増加に活用できます。

ストキャスティク外国為替戦略におけるリスク管理の適用

リスク管理は、ライブ口座で取引を始める前に獲得すべき基盤です。ストキャスティクスインジケーター外国為替は非常に信頼性が高いですが、リスク管理は資金を保護し、より多くの利益を得て負け取引を減らすのに役立ちます。

- あなたが実際に利用可能な資金に基づいて受け入れ可能なリスクレベルで取引を行います。 レバレッジ取引 は利益を上げることができますが、このツールを慎重に使用する必要があります。

- 常に各取引にストップロスを設定してください — 取引が不利になった場合、注文は自動的にクローズされます。 最高のForexロボット を使用することもできます、特に初心者の場合は。これにより、自動的にプロの意思決定を行い、Forex取引の習熟度を高めるのに役立ちます。

- 感情や衝動が制御を奪うのを防ぎ、必要以上に取引に滞在しないようにするために、利益を確保するレベルを決定してください。

- デイトレードが好きでない場合やスキャルピング戦略を使用していない場合は、同時に多くの取引を開かないようにしてください。これにより、作業量が減少し、努力なしにすべてをコントロールできるようになります。

ある取引がすべての努力にもかかわらず失敗に終わる可能性があることに事前に準備してください。これは失敗ではなく学習プロセスの一部です。特定の期間にわたる活動を分析し、結論を導き、それに応じて進んでください。

高度なテクニックと考慮事項

ストキャスティック信号Forexインジケーターを適用することと高度な取引テクニックを組み合わせることで、トレーダーはより自信を持って効率的に取引を行い、戦略を最適化し、より効果的にします。

包括的なデータを得るために複数の時間枠を分析します

偽のシグナルを排除するために、ストキャスティックオシレーターを複数の時間枠で使用してください。これにより、市場の広い視野と実際に起こっていることのより良い理解が得られます。時々、1時間足のチャートでオシレーターを使用しながら、4時間足のデータを検討することで、予測を確認または否定できます。いずれにしても、このアプローチは衝動的な取引決定から保護し、実際のトレンドや価格の動きを特定することを可能にします。

ストキャスティックのダイバージェンスを活用する

価格が変わらない状態でストキャスティックオシレーターが高値または安値を示すと、ダイバージェンスと呼ばれる現象が発生します。これはブルッシュまたはベアリッシュになります。ブルッシュのダイバージェンスは価格が上昇する可能性を示唆し、ベアリッシュのダイバージェンスは価格が下降する可能性を警告します。どちらのシナリオも特定の条件下で有利ですが、これらの機会を迅速に特定することが重要であり、ダイバージェンスを追跡することは取引の武器として貴重なツールです。

移動平均線、RSI、MACD、および他の指標を使用して包括的で明確な市場洞察を得る

これらおよび他のテクニカル指標を使用することで、偽のシグナルの数を減らし、利益をもたらす取引や良いリターンにつながる可能性のあるチャートに焦点を当てることができます。特に、トレンドラインと移動平均線は潜在的な価格反転ポイントを特定する最良の方法です。これらの指標をオシレーターから受け取るデータと組み合わせることで、資産に関するよく考えられた決定を行うことができます。

規律はトレーダーの最良の友人です

戦略を継続的にテストし、最適なオシレーターパラメーターを調整し、上記のスキームに従ってリスクを管理してください。潜在的な利益がリスクを大幅に上回る取引を行い、リスクリワード比が明らかに不利な取引を避けてください。トレードが初めての場合は、市場の安定性に大きな影響を与える主要な経済ニュースが発表される際の取引を避けるようにしてください。プロのトレーダーや経験豊富なトレーダーでも、このボラティリティに苦しむことがあり、誤ったシグナルに反応することがあるため、あなたに逆効果となる可能性があるシグナルを無視する方が良いでしょう。

また、詳細なガイドからのヒントに従って、取引中に資産を保護する方法について多くを学ぶことができます。

バックテストと練習

バックテストを行うことで、市場の変化に対応し、競合他社を上回る戦略を継続的に適応させることができます。ただし、バックテストは継続的な練習なしには不可能です。練習を通じて、変更や改善したいニュアンスを特定できます。カオスではなく体系的に行動するために、次のヒントを基盤として考えてください:

- 特定の期間にわたる歴史的な価格動向データを検証します。

- テストから得られたシグナルを手動で確認します。

- 取引ジャーナルを保持し、自分自身の記録を分析して、戦略の利点と欠点を迅速に特定します。

- ルーチンプロセスを自動化する可能性を無視しないでください。

- トレードスタイルに合わせてオシレーターの設定を最適化します。

- 以前の決定の大部分の効果を確認した後に、トレードボリュームを徐々に増やしてください。

学び続け、常に変化に適応し、調整する準備をしておくことをやめないでください。外国為替市場は非常にダイナミックで絶えず進化しているためです。

ボトムライン

ストキャスティックオシレーターは、あなたの忠実な助手となり、過買いと過売りのエリアを効果的かつかなり正確に特定し、資産の買い付けや売り付けのための明確なシグナルを提供する準備が整っています。ただし、このツールを徹底的に研究し、その設定を理解し、戦略をテストして最適化することが大規模な取引に適用する前に必要です。