外汇市场是一个新手和专业人士汇聚的地方,成功故事和失败并存。吸引人们来到这个市场的是众多的卖家和买家,他们都有机会进行技术和基本分析,获取高流动性货币,并执行最佳交易。此外,每个人都可以独立工作并利用最佳外汇机器人,这些机器人可以自动化例行流程,使交易员能够专注于改善他们的策略,优化它们,学习并做出最终决策。

中心化与去中心化:外汇市场格局

在进行交易之前,熟悉您将工作的环境至关重要。就像新来公司的员工首先确定办公楼的楼层数和每个办公室的位置一样,新手在这里需要了解外汇市场结构。这有助于更好地理解影响价格和趋势的因素,需要注意的事项以及要寻找的内容。基本上,外汇市场结构就像您的指南针,使您能够理解这个市场的性质和运作方式。

中心化市场是一个系统,所有交易操作都通过一个单一的交易点进行,从主要到次要。这个点可以是银行或其他金融机构。在中心化系统中,主要的影响领域属于伦敦、纽约和东京等金融城市。它们是开启和关闭交易会话的主要地点。

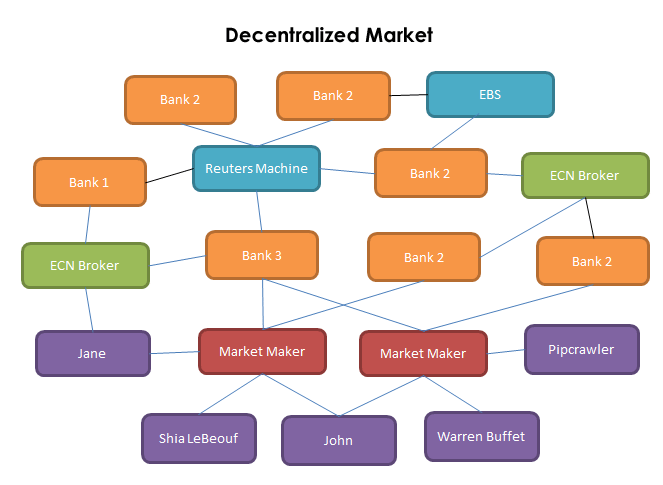

与集中市场不同,分散市场没有单一的交易所,交易直接在市场参与者之间进行:银行、公司和私人交易者。交易通过银行间系统或电子通讯网络(ECN)进行。与集中市场不同,这个市场更容易接触到广泛的用户,并经常提供更好的价格。然而,还有一个不同之处:交易缺乏透明度。

那么,外汇市场属于哪种系统?集中化还是分散化系统?

事实上,外汇结合了两种系统的元素,为用户提供了两种选择的优势。这使得它灵活、动态和透明,但不像传统的集中化系统那样受限。这正是吸引全球用户的原因。

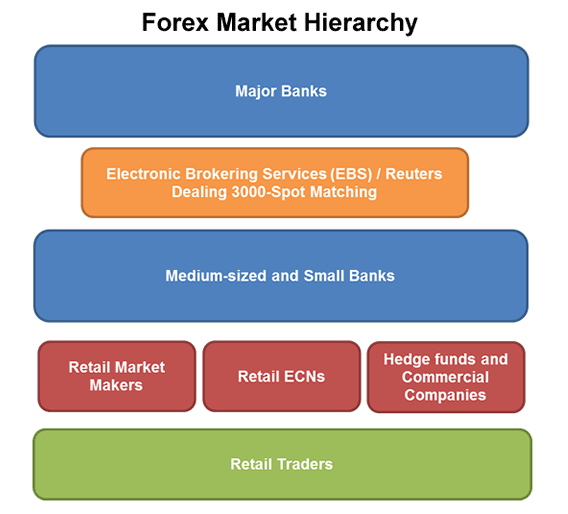

分散式外汇市场结构的组成部分

由于其特点,外汇市场结构在很大程度上是分散的。中央机构不控制外汇市场,因此货币对的价格可能会受到所有市场参与者的影响,结果是没有为特定日期设定的稳定和统一价格。不同交易商的报价不同,在交易过程中,您可以通过将您的请求与流动性池中提供的可用报价进行比较,选择最佳选项。尽管这可能看起来混乱,但这种定价实际上是竞争性的,价格受到处于层次结构顶部的大型银行和私人交易者的影响。

银行间市场

银行间市场允许在外汇市场进行大额交易。各大银行参与此过程,要么相互交易,要么利用EBS(电子经纪服务)和路透社匹配等平台。它们相互竞争,争夺外汇市场结构中的最高地位,寻求最佳汇率。参与此过程的各方越多,货币对的流动性越高,汇率也越好。然而,只有具有适当信用和声誉的机构才能获得这些交易的机会,因此尽管市场没有中央监管,交易仍遵循相当严格和不可改变的标准。

机构市场

机构市场包括ECN经纪商、金融机构、对冲基金等。尽管这些机构对市场的影响力稍逊于银行,但它们是银行和零售交易者之间的桥梁。这里的汇率比零售交易者更有利,但不及银行使用的优惠汇率。

零售市场

零售市场是外汇市场结构中的最低层。它包括通过电子交易优势获得进入货币市场的所有交易者。这里的汇率相对于结构中的两个更高层来说是最不利的。然而,仍然存在出色的交易机会,尤其考虑到有声誉的经纪商在争夺客户时努力提供最佳条件。因此,即使是零售交易也可能是一个有前途的选择,独立交易者可以利用这一优势,而无需成为任何金融机构的一部分。

交易即期外汇:探索去中心化框架

在討論外匯市場結構時,解釋即期外匯交易的概念是至關重要的,因為這對於全面了解市場至關重要。即期外匯交易是指“當場交易”,意味著以當前匯率買賣貨幣對。外匯交易使您能夠操作資產而無需擁有它們。這意味著每次開倉和平倉的成本較低,價差也較小。因此,如果您堅持短期策略,由於這一點,您具有某種優勢,甚至可以實踐快速交易,而在其他條件下,這將帶來最小的利潤。

即期貨幣交易的另一個特點是您始終在交易一個貨幣對:賣出一個(基幣)並買入另一個(報價幣)。因此,您從一種貨幣相對於另一種貨幣價格將發生變化的假設中獲利。在這種情況下,如果您的預測正確,您將獲得相應的利潤。請記住,即期交易在短期決策的背景下特別有利。如果您在市場關閉後保留頭寸,經紀人可能會收取過夜費。考慮這些特點和風險以獲取利潤並進行有效的風險管理。

結論

了解外汇市场结构的组织方式至关重要,这样您就可以理解价格是如何形成的,谁在影响价格,以及应该监控哪些新闻以避免意外事件。了解外汇市场的结构和特点有助于有效管理风险,进行精确的基本分析,并密切监控出现的最佳机会。这也是为什么在与其中一个经纪人合作时,您应该仔细考虑不同经纪人的条件(否则,零售外汇交易是不可能的)。