在進行技術分析時,交易員依賴各種信號和指標來幫助他們識別最佳的交易機會,預測趨勢變動並做出明智的交易決策。他們在使用最佳外匯機器人時也使用這些工具,因為自動交易也涉及使用這些工具。對於交易員來說,最好且最受歡迎的指標之一是外匯指數移動平均線(EMA)。

理解指數移動平均線

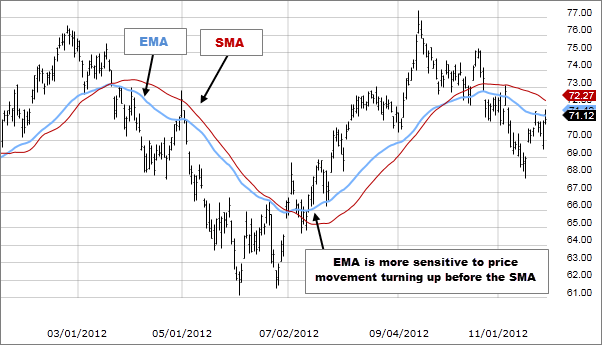

外匯中的指數移動平均線是什麼?指數移動平均線(EMA)是一種流行的技術分析工具,提供了大量有關最近價格數據和其他市場條件的信息。EMA外匯有助於識別趨勢、潛在反轉以及支撐或阻力水平。

與簡單移動平均線(SMA)不同,該工具專注於市場中最近價格變動的信息。它考慮了當前收盤價、先前的EMA值和平滑係數,提供比SMA更多的信息。交易員需要這些信息來查看短期EMA與長期EMA相交的位置,以確定趨勢及其方向。此外,該指標還允許在交易中找到最佳的進出點。此外,外匯中的EMA還可用作動態支撐和阻力水平。在這種情況下,交易員可以識別並評估可能出現買賣壓力的潛在水平。

EMA的類型

外匯中的指數移動平均線根據其涵蓋的期間分為三種主要類型:

- 基於5、10或20個週期確定的短期EMA。 短期EMA對市場價格變動反應非常迅速,使其成為具有短期策略(如日內交易)的交易者的理想選擇。

- 在分析50或100個週期時,這樣的EMA變為中期。 雖然短期類型對價格變動非常敏感,但在這裡,此信息與平滑係數平衡。 這提供了較少的機會從短期趨勢中獲利,但為實踐中期趨勢的交易者提供了有用的數據,以根據其交易計劃和策略做出有效的投資決策。

- 相應地,長期EMA適用於長期投資者。 它提供了200個週期甚至更多的信息,提供了關於主要趨勢和潛在逆轉的更一般的圖像。

在這些類型的EMA中,沒有絕對更好或更差的。 每個交易者根據其交易策略決定使用哪種工具。

如何計算EMA

在外匯市場中決定如何計算指數移動平均值是至關重要的。 這種計算基於一系列因素。 計算公式考慮了週期、平滑係數和初始EMA。 如果我們逐步查看計算,算法如下:

- 外匯計算指數移動平均值始於選擇要包含在計算中的週期數(N)。 因此,這可以是從5到200個週期或更多,取決於您將使用的EMA類型。

- 使用公式SF =(2 /(N + 1))計算平滑因子(SF)。 正如您所看到的,係數取決於選定的週期數。

- 使用SMA找到第一個週期的值。

在實踐中,外匯計算指數移動平均值是什麼樣子?這裡有一個簡單的計算示例,讓您看看如何確定一系列收盤價的10期EMA:

示例:

收盤價:25, 30, 35, 40, 45, 50, 55, 60, 65, 70

計算平滑因子(SF):

SF = (2 / (N + 1)), 其中N = 期數(在這種情況下為10)

SF = (2 / (10 + 1)) = 0.1818

計算第一個EMA:

EMA(1) = 收盤價(在這種情況下為25)= 25

使用公式計算後續EMA:

EMA(當前) = (收盤價 - EMA(前一個)) * SF + EMA(前一個)

示例:

EMA(2) = (30 - 25) * 0.1818 + 25 = 26.818

EMA(3) = (35 - 26.818) * 0.1818 + 26.818 = 28.368

對每個後續期數重複此過程,以得出完整的EMA系列。

外匯交易中的指數移動平均線

EMA在外匯中的重要性是無價的。作為分析價格趨勢的工具,這個工具可以被視為最方便和信息豐富的。為了證明這一點,讓我們探討這個指標是如何工作的,以及它為交易者提供了什麼數據。

使用EMA進行趨勢識別

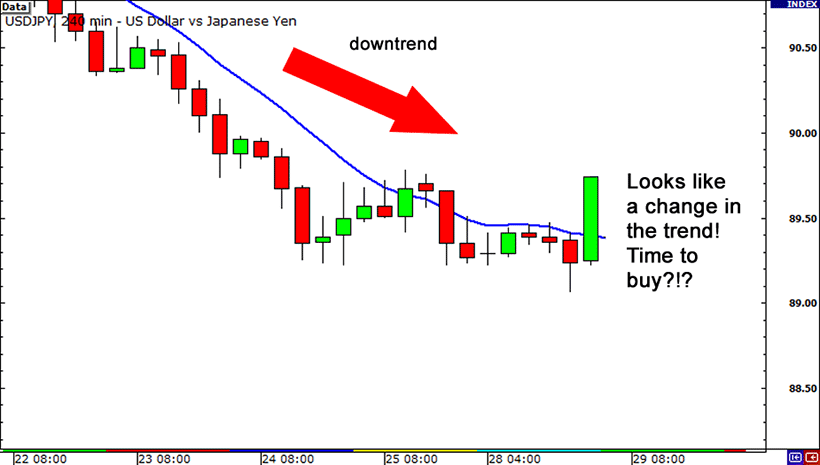

如何使用指數移動平均外匯? 它最常用作識別趨勢的工具。 在時間框架上的不同期間內的EMA有助於可視化趨勢方向。 當短期EMA穿過長期EMA時,表明上升趨勢,而穿過下方則表示下降趨勢。 這是使用此工具的傳統方法。 因此,當價格從下方移動到上方的EMA時,會注意到牛市趨勢,當價格水平穿越EMA時,則被認為是熊市。 移動平均線的上升斜率表示牛市趨勢,而下降斜率表示熊市。 這是了解趨勢方向的直接方式。 但是,它忽略了有關價格行動的信息。 因此,有經驗的交易員也會注意到這一因素。 這樣做可以使他們免於過度依賴單一指標並未能驗證僅使用其他信號獲得的預測和數據的潛在陷阱。

如果趨勢強勁且已確立,您將注意到帶子位於移動平均線期間的上方/下方。 但是,這種方法有一個輕微的缺點,即時間延遲。 因此,對於那些工作迅速並專注於日交易的人來說,這種趨勢確定方法將被證明是無效的。

EMA 交叉策略

EMA交叉已被討論為確定趨勢方向的一種方法。 當短期EMA與長期EMA相交時,就會出現交叉,使您能夠看到購買或出售的最佳機會。 因此,EMA不僅指示趨勢方向,還作為下一步該做什麼的良好建議:買入還是賣出。

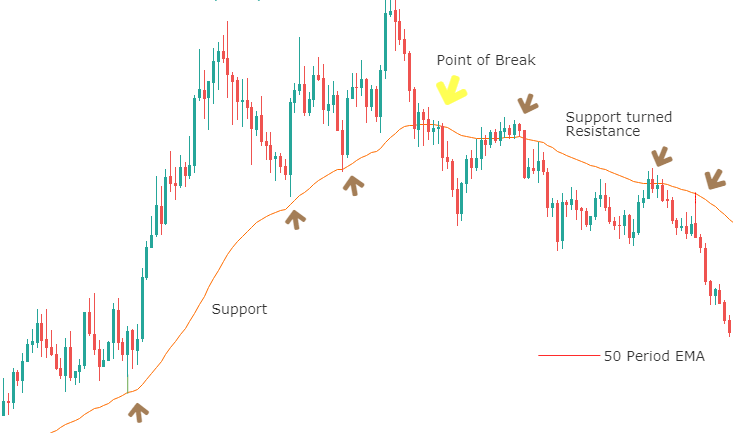

EMA作为支撑和阻力水平

有趣的是,还有另一种使用EMA的方法,即利用它作为动态支撑和阻力水平。当趋势向上时,外汇EMA充当支撑水平。相反,一旦趋势转为向下,外汇EMA就变成了阻力水平。通过观察这些水平在时间框架中的反映,您可以有效地并相当准确地评估趋势的强度。

使用EMA进行风险管理

外汇中的EMA是什么?它不仅是一种分析工具。您还可以将其用作风险管理工具。例如,您可以看到设置止损订单、移动止损或在一定距离内设置获利水平的最佳点。此外,交易者可以寻找图表上多条线之间的收敛/发散(例如长期和短期)。这有助于衡量趋势的强度,并提供市场波动性和潜在风险的概念。因此,除了标准的降低风险和保护自己的方法之外,您还可以使用EMA来减少低利润或亏损交易,并赚取更多利润。

最重要的是

EMA是一种多功能工具,这就是为什么它在交易者中如此受欢迎。很难不注意到它有助于找到最佳的交易机会,识别趋势,并确定进出交易的最佳时机。如果您学会正确使用这些线,您就可以始终保持领先,并在每天的交易中取得成功。不要忘记使用其他指标验证预测,并使EMA成为您每个交易日的可靠助手!